Purpose

You may effectively organise and plan your investments by using this area to track all of your orders in real time.

Accessing Order Book

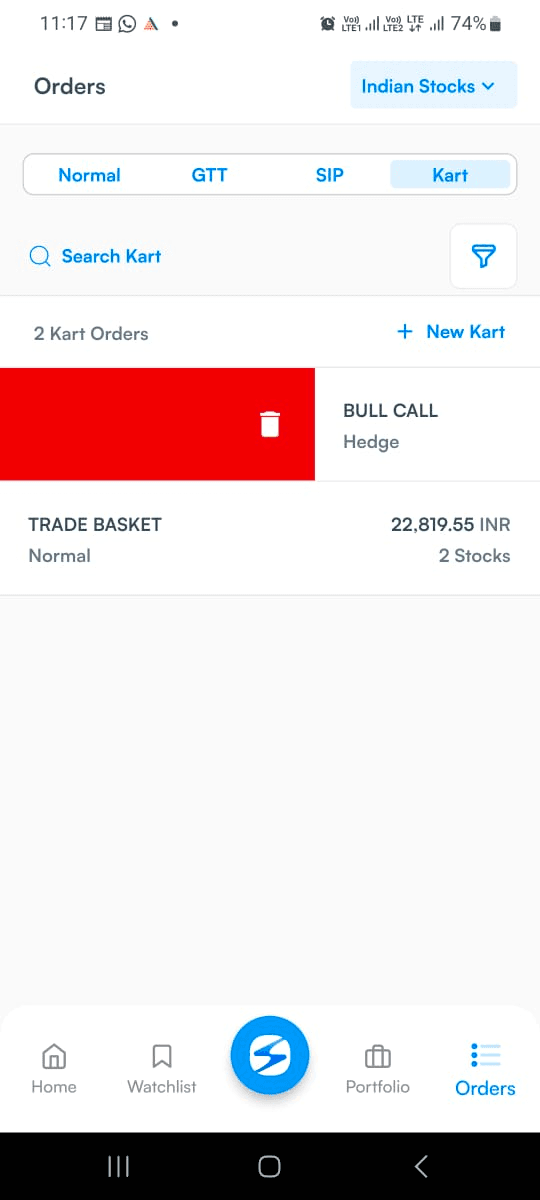

After you log in, tap the Orders icon at the bottom right corner of the screen. It will take you to your order book. By default, it will show you Normal orders. To see and modify Good Till Triggered (GTT) order, toggle to GTT. To see and modify systematic investment plan (SIP) orders, toggle to SIP. To see and modify Kart orders, toggle to Kart. You can also create new Kart from here as shown below

Open orders/Normal

This section will show you the list of all the orders given by you.

Each order in the list is accompanied by the following details –

- Name of the asset (along with details)

- Additional details e.g. if the order is an option, then the following details will be mentioned –

- Maturity date

- Strike price

- Option type i.e. call or put, intraday or delivery

- Action – buy or sell

- Lots traded in that order

- Order price

- Status of the order e.g. pending

Filtering open orders

You can filter your Open Orders and Positions based on the following

- Instrument type - NSE, BSE, NFO etc

- Order type - Market, Limit etc

- Product - Intraday, Delivery

- Position - Long/Short

- Order Status - Completed, Cancelled, Rejected etc and

- Sort By

GTT

You can place a GTT order by going to either the “Buy” or the “Sell” sections of an asset and clicking on the “Create GTT/GTT Order” option.

Once you have placed the order you can track the order through the section of GTT under the Orders section of the app.

Once you reach the GTT section, you will see the list of your GTT orders. Each order will have the following information on this page –

- Name of the asset

- Action – Buy or Sell

- Quantity (Qty)

- Expiry date

- Trigger price – In larger font

- Last Traded Price (LTP) – located right below the trigger price

- Investment type – Delivery or Intraday

- Limit Price

- Option to “Cancel Order”

- Option to “Edit Order”

SIP

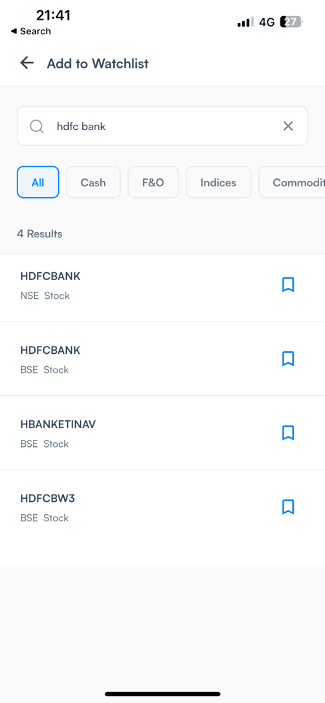

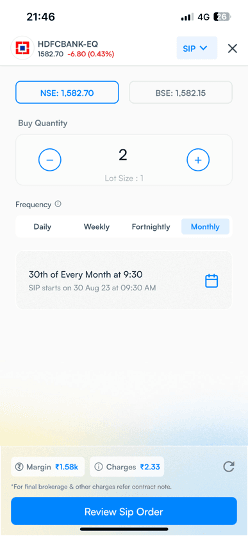

Go to the SKY App > Search

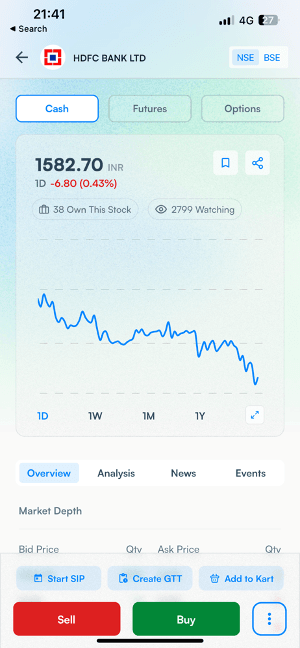

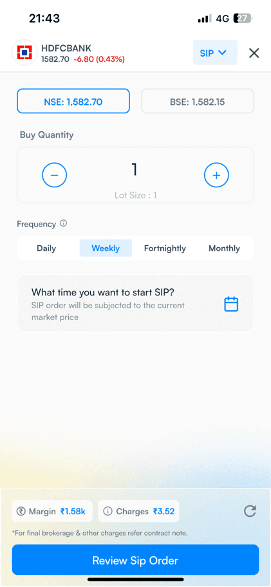

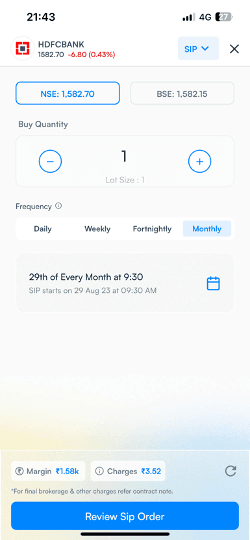

2. Search and select your preferred stock/ETF Example – HDFC Bank Ltd.

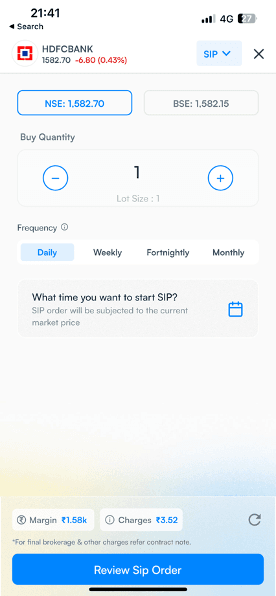

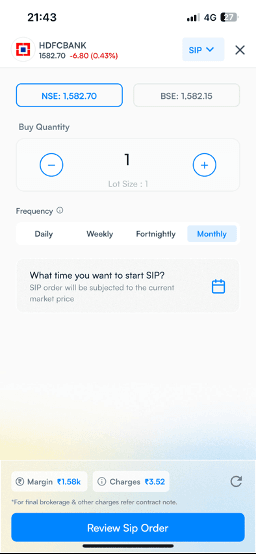

3. Tap on Start SIP

4. Select your Preferred Exchange and Qty and Frequency. We provide you 4 frequency option – Daily, Weekly, Fortnightly, Monthly.

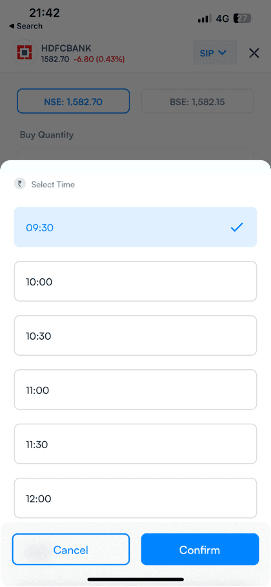

Example – Selecting Daily

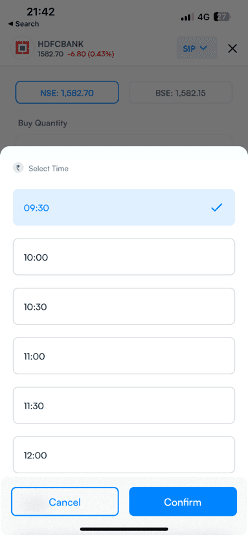

- Enter your preferred time for SIP trigger starting from 9:30 to 15:00

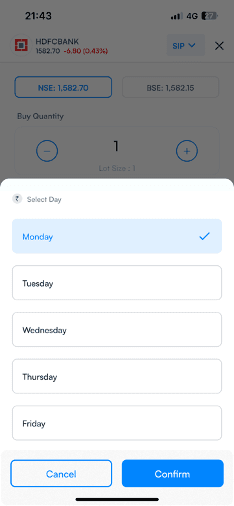

Example - Selecting Weekly

- Select your preferred execution day

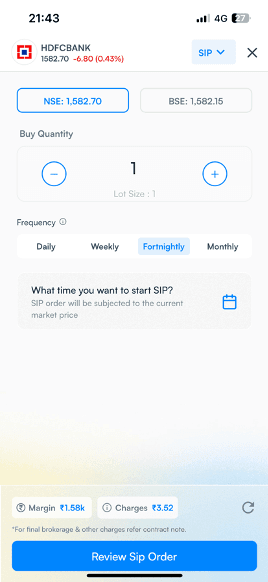

Example – Selecting Fortnightly

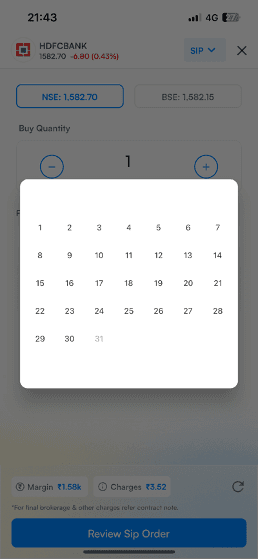

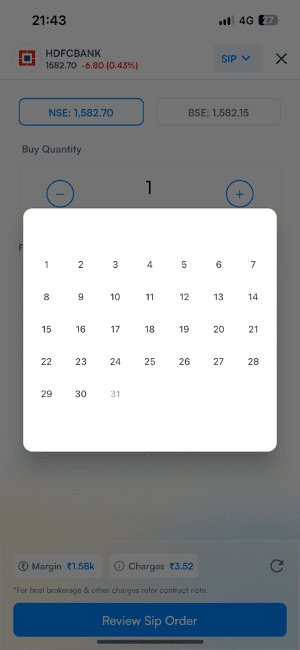

5. Tap on Calendar option and select your preferred SIP start date from calendar displayed.

If you select date which is less than current date it will consider that start date of next month. If you select date which is current or greater than current date it will consider that start date of current month.

Example – Selecting Monthly

- Tap on Calendar option and select your preferred SIP start date from calendar displayed.

If you select a date which is less than current date it will consider that as the start date of the next month. If you select a date which is current or greater than current day it will consider that start date of the current month.

Example – Selecting 29th as start date

- Select preferred time.

Example – Selecting 9:30 am

6. SIP start date is shown on screen – 29th of Every Month at 9:30 with SIP starts from 29th Aug’23 onwards.

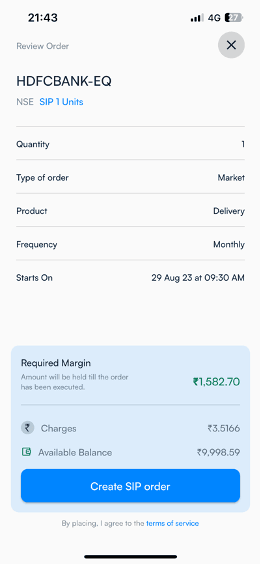

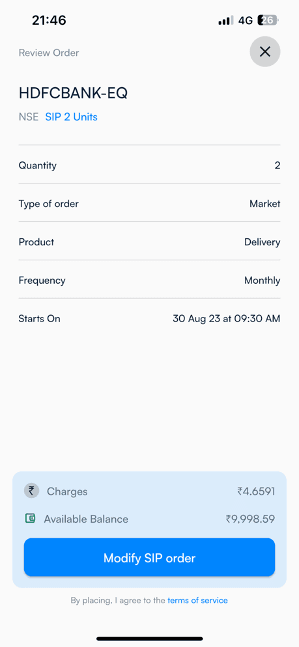

7. Tap on Review Sip Order

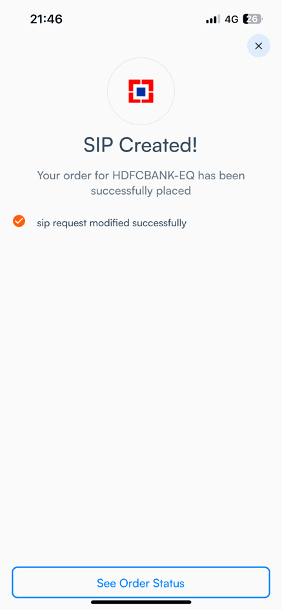

8. Tap on Create SIP order on SIP confirmation screen

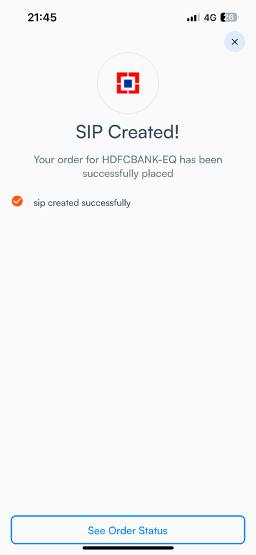

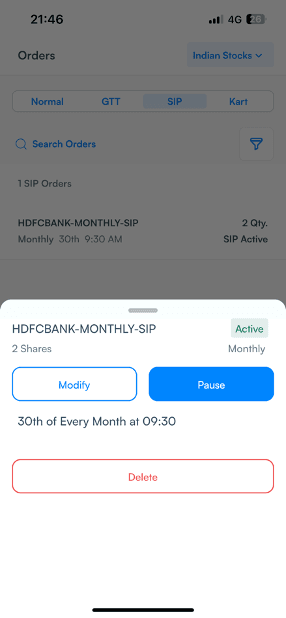

9. All done! Get status of your created SIP by clicking on “See Order Status”

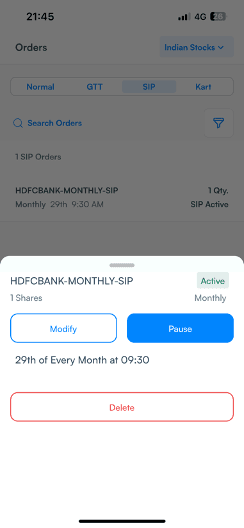

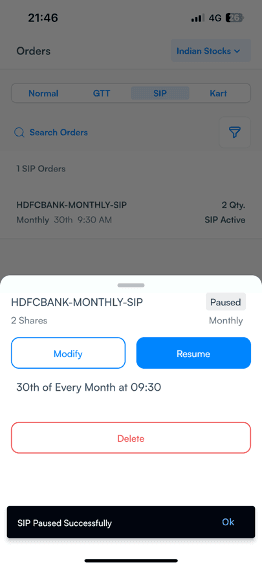

10. You can Pause/Modify/Delete your SIP by tapping on the SIP information card

- Tap on your preferred option for further action.

Example – Tap on Modify

11. You can modify your Qty, SIP Frequency.

- Click on “Review SIP Order”

12. Review the changes and click on “Modify SIP order”

13. SIP modification confirmation message

14. Click on "Pause" to Pause your SIP

- SIP Pause Successfully confirmation message will be displayed

To Resume click on “Resume”

To delete SIP click on “Delete”

15. SIP orders can be review by clicking on the Hamburger menu on the top left hand side > SIP Orders

Kart

Next to ‘SIP’, we have the section on ‘Kart. Let us now set some context on what is a Kart and what are Kart orders.

How to Create a New Kart from Orders?

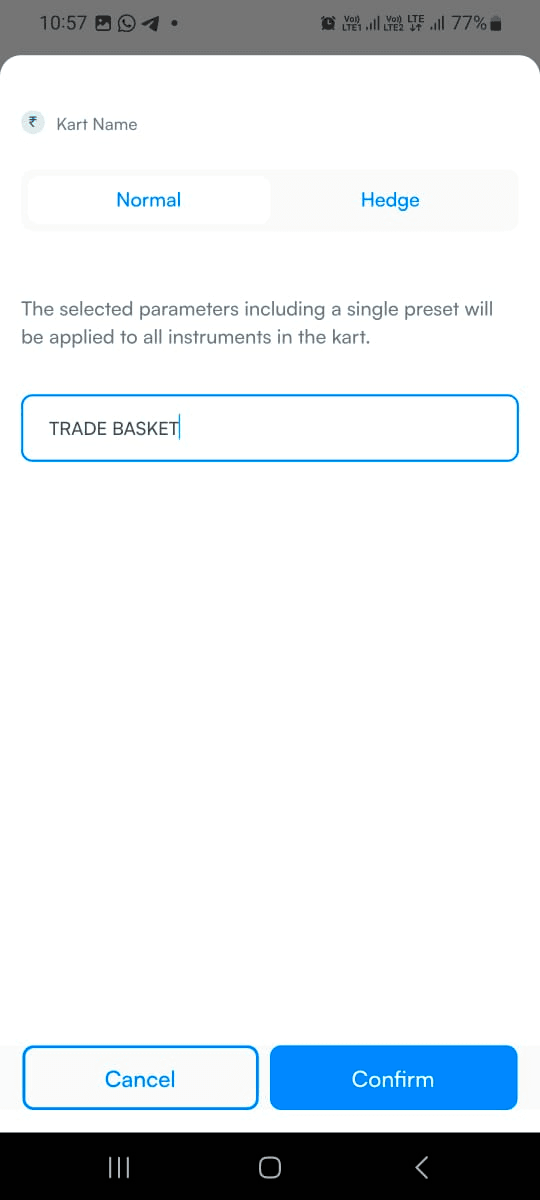

Understanding the Two Types of Kart Orders:

- Normal Kart: In this type of KART order, all the added stocks will be placed in the market simultaneously, without any time interval or holding between two orders.

- Hedge Kart: The Hedge Kart is designed specifically for Hedge-based F&O trades to provide margin benefits. Usually, hedge orders in options reduce the margin requirement to 1/4th of the original margin. However, brokers typically offer this benefit only if you place the BUY Option trade first and it gets executed before placing the SELL Option order. But with our Hedge Kart, you get this benefit even if you place the SELL order first. We send all orders as a market order in Hedge Kart, ensuring your orders are executed with the minimum margin required.

So, whether you are a beginner in the stock market or an experienced trader, KART is the ultimate feature that streamlines your trading experience and helps you execute multiple orders effortlessly.

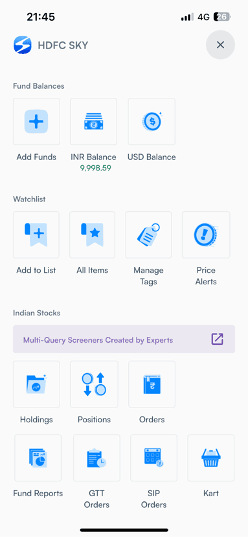

Discovery of Kart:

1. Go to Sky App > Orders

2. Tap on Kart

3. Tap on Create Kart and Name your Kart

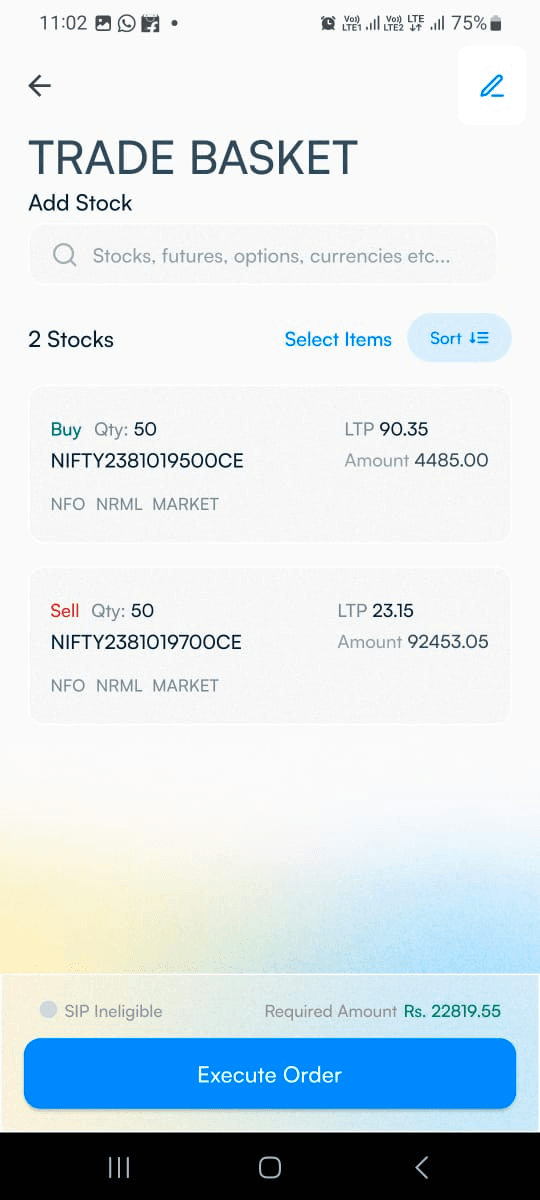

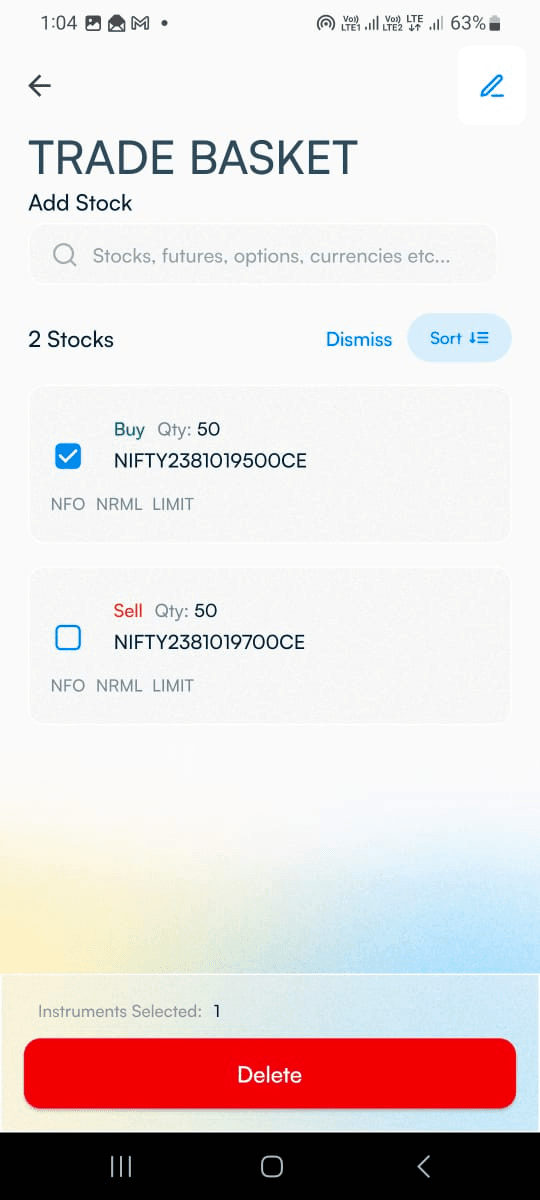

4. Add stocks to your Kart

5. Fill the required details for the order like Quantity, Product type, Order type etc and click on Review Order

6. After review the order click on Add to Kart

7. After adding multiple stocks click on Execute Order.

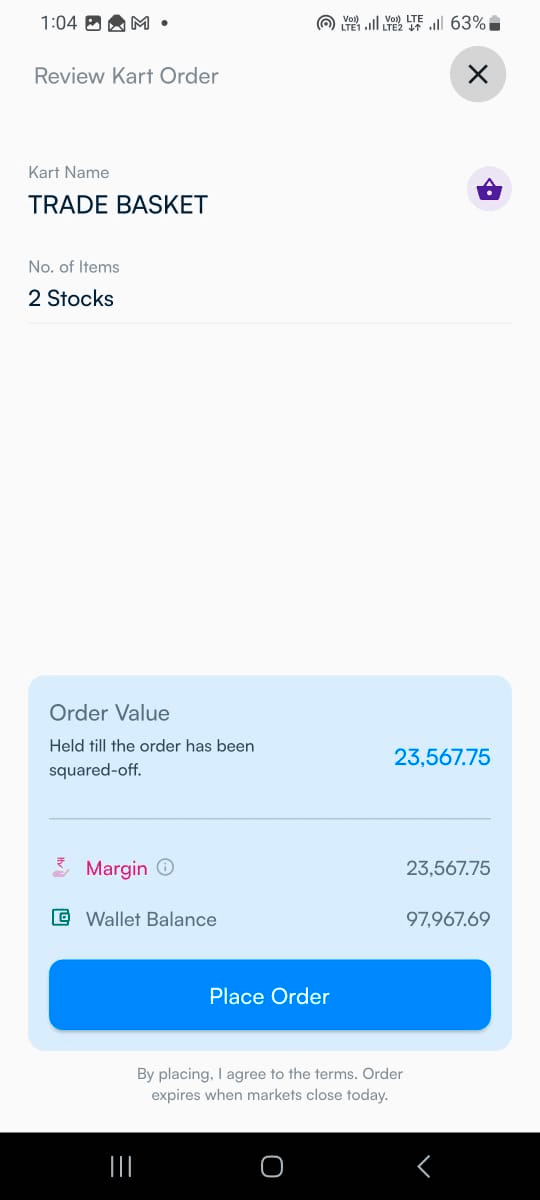

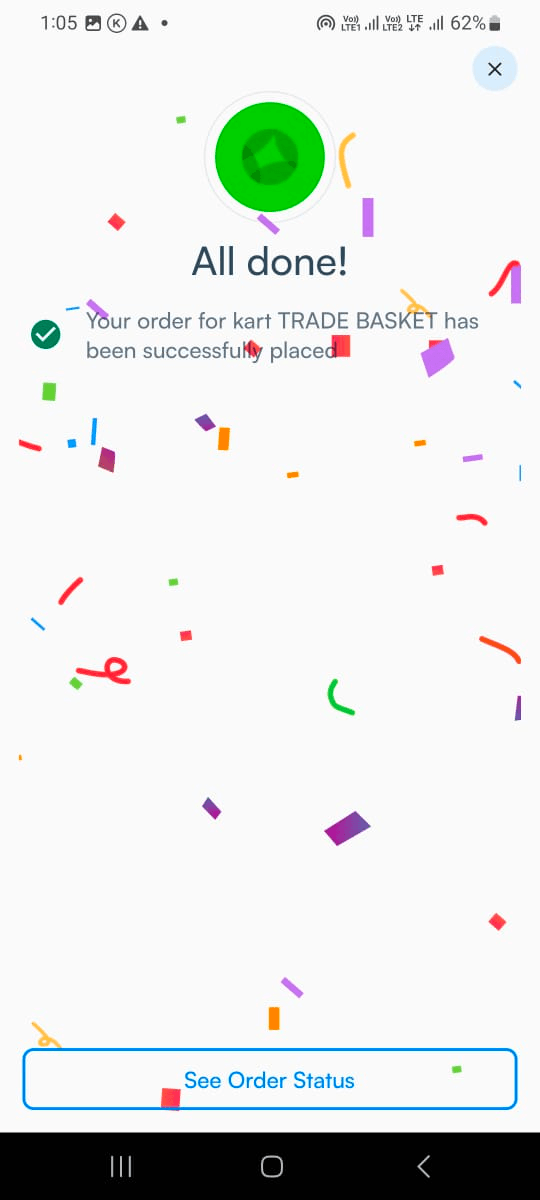

8. Review the required margin for your basket and click on Place Order

9. All Done!! Get status of all your kart order from the Orders section

10. You can delete added stocks by selecting choice of stock and also you can sort the stocks as per your preference.

11. You can delete the entire Kart by right or left swiping.