This part serves as an introduction to the world of trading and aims to provide the user with as much knowledge and expertise as possible prior to them beginning to trade.

Section wise description

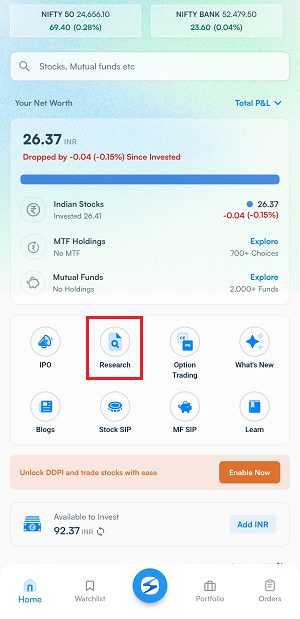

Notifications and Announcements

This section contains all your important notifications, market alerts and news that can help you stay up to date about the market. You can reach this section by clicking on the bell icon on the top right of the Home page. Indices Three Pinned Indices at the Top Search Bar Which lets the user to search Stocks, MF etc.

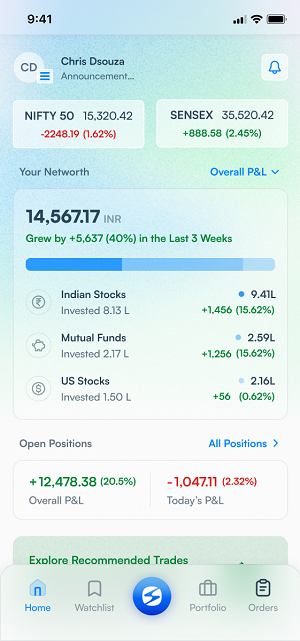

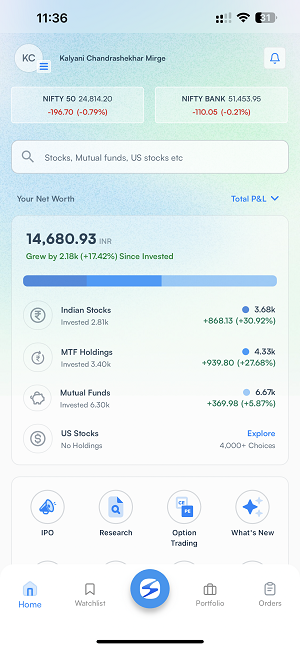

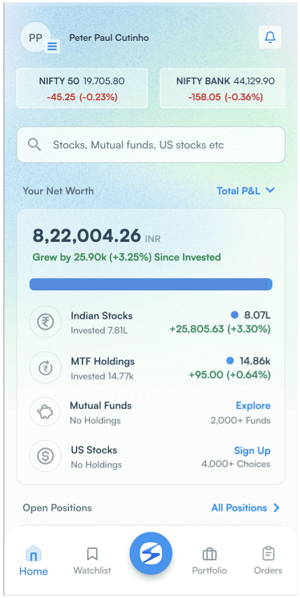

Your Net Worth

This section tells you the total of all the investments be it MF or Stocks etc.

IPO

Selecting this icon takes you to the list of Applied, Open and Upcoming IPOs. For each open and upcoming IPO, initially the minimum investment required and price range will be mentioned (as and when the details are available). You can bid at any price of your choice within that price range.

- Clicking on this, you will get three sections: Applied, Open and Upcoming.

- Applied section: This has a list of IPOs that you have already applied to with information such as IPO name, No. of units, Blocked Amount, Order Status.

- Open: This has a list of IPOs that are open to invest in with information such as IPO name, Price Range, Min. Bid Amount, Application Status.

- Upcoming: This has list of IPOs which are yet to open in other words, the list includes upcoming IPOs slated to be launched in a year from now.

- Research IPOs and identify their potential investments.

- Apply for shares through SKY during the IPO period.

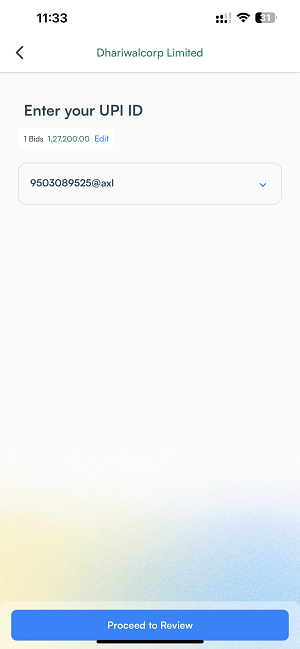

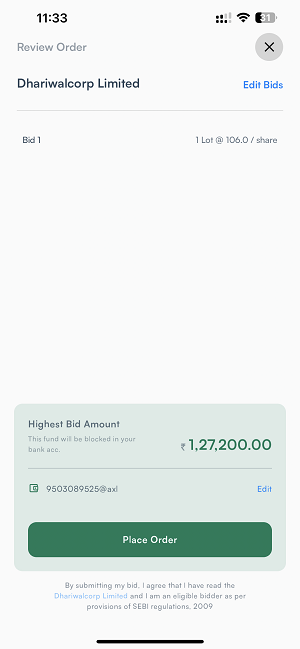

IPO Application Process

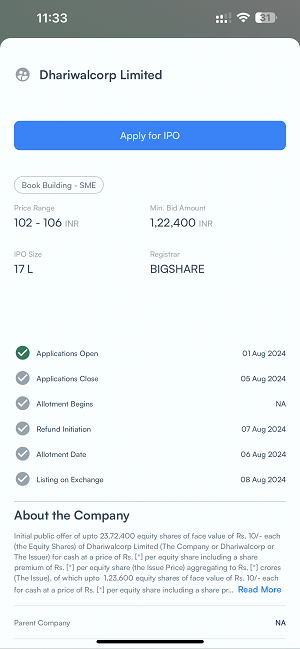

In the SKY IPO section, you can click on your desired open IPO to invest in.

- A mini page will give you details of IPO.

- You can simply click on Apply on IPO button to proceed.

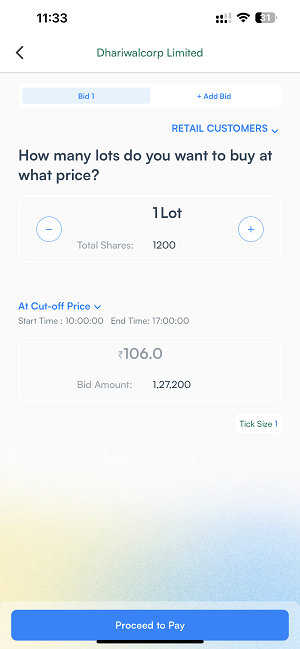

- Further, enter the price at which you want to apply for shares and the number of lots.

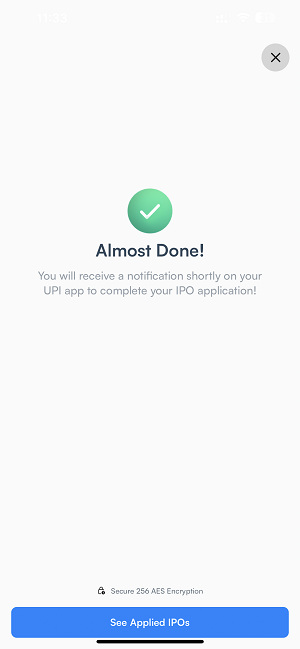

- Once you proceed, you will be asked to confirm the amount to be blocked from your account, agree to necessary terms and conditions and submit the IPO application.

- Now, Open the UPI app and Authorize the amount to be blocked.

Clicking a particular open IPO will give you further information such as:

Minimum investment (both in terms of money required and number of shares per lot)

Price range, Discounts (if any)

Issue size

Important dates

In addition to the above, scrolling down further will show you about the company.

Bidding Window – This signifies the dates when the offer starts and when the offer ends – during this period the users are free to cancel or modify their IPO orders.

In order to submit a successful application, you need to accept the mandate before 5:00 pm of the offer end date from your payment service provider’s application e.g. GPay, PhonePe, etc. In case you are unable to find your payment mandate, log in to your payment service provider’s app > Go to the Mandate section > Check for pending mandates.

Allotment Date – This is the date when you get to know whether you have been allotted the shares you applied for or not. The allotment is done on a completely random basis by the Registrar – but HDFC SKY will also communicate to you about the allotment (through SMS, email and in-app notification).

At this point, if you have received the allotment, the shares will be credited to your demat account one day prior to the listing of the issue in the secondary market. For the users who did not receive their allotment, their funds will be unblocked within 3-4 days of the allotment directly from your bank. Therefore, if you have any queries regarding the unblocking of funds, you should contact your bank directly.

Listing date – On this date, the IPO is listed on the secondary market at 10:00 am. Thereafter, you can log in to your HDFC SKY account and check out your position from the app’s portfolio section.

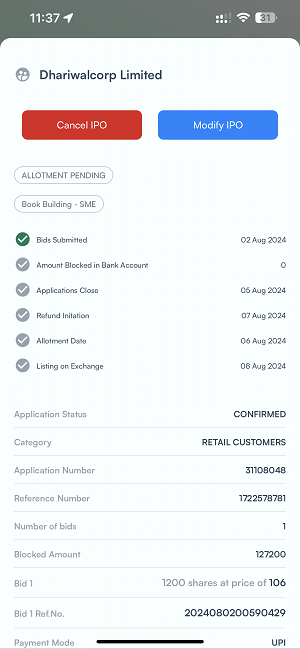

IPO Orders

Tapping on "Applied" takes you to the list of IPO orders made by you. Here you can see a list of the IPO orders that you have invested in so far. Under this section, you can see the following details related to the aforementioned IPO orders –

Name of the company

Investment amount

the number of lots invested

Bid Submitted date

Amount blocked date

Application close date

Refund Initiation date

Allotment Date

Listing Date

Clicking on any of these IPO orders will lead you to a page where further details of the IPO orders are given such as Allotment Status Further application details

Note: At this point you can choose to modify the IPO order by clicking on the “Modify Order” Button.

We allow the users to cancel or modify their IPO orders not only before the placing of the order but even after your funds have been blocked (in lieu of the particular IPO order). However, the user cannot cancel/modify the IPO order once the bidding window for that IPO is closed. In the event that you cancel your IPO application or your application gets rejected due to other reasons like mandate expired, invalid UPI ID or other technical reasons, you will still have the option to “Apply Again“ on the Order page.

Research

This section tells the user about the scrips which have been recommended by our in-house research team This is divided in to three parts

- Technical - These are the recommendations based on the technical parameters of the company and are of short term.

- Fundamental - These are the recommendations based on the fundamental parameters of the company and are of long term.

- Trading - These contain F&O scrips The search bar allows the user to search the specific scrip if it is available in the list, it will be displayed Filter & sort at the top right will allow the user to arrange on the basis of Type, Horizon and Sort by.

Option Trading Platform

This section takes you to a realm of options trading, which is made easier even for the novice user Unlocking Precision in Trading Decisions:

Forecast Level is your ultimate companion in decoding the F&O strategy based on your Forecast. With Forecast Level, you now have the power to select your desired level for the underlying asset and Forecast whether it will soar above, dip below, or gracefully dance between your chosen thresholds. Based on your Forecast the system will auto populate all the strategies best suits your view. Empowering Informed Decision-Making: Say goodbye to the guesswork! Forecast Level empowers you with tailor-made strategy recommendations aligned perfectly with your market outlook. No more sifting through endless strategies manually;

Our platform does the heavy lifting for you. Armed with essential metrics like maximum profit/loss, breakeven points, and margin requirements, you can now make informed choices that resonate with your risk appetite and reward expectations Insightful Analysis at Your Fingertips:

Knowledge is power, and Forecast Level ensures you're armed to the teeth. Dive deep into the profitability and risk profiles of your chosen strategy through detailed analysis with Pay off Analyzer before execution. With just a few clicks, you'll unravel the potential outcomes across different price levels of your target stock or index, enabling you to navigate the markets with confidence and clarity.

Seamless Execution, Real-Time Monitoring: Efficiency is the name of the game, and Forecast Level ensures you stay ahead of the curve. Execute your selected strategy seamlessly with just one click, streamlining the trading process like never before. And the best part? Monitor the profit/loss of your strategy in real-time, empowering you with the agility to proactively manage and optimize your positions as market dynamics unfold.

Finding the Option Trading Platform in HDFC Sky App: Now, you might be wondering, "How do I access this revolutionary feature?" Fear not, for it's simpler than you think! Within the HDFC Sky App, navigate to the 'Invest' section, and voila! You'll find the Option Trading Platform nestled comfortably, waiting to unleash its full potential at your command. Predict Level brings a whole new way to trade options – it's like a fresh start where knowing exactly what to do is easy, and making smart choices is key. Traders, get ready! Dive into the future of trading with HDFC Sky App's Option Trading Platform, where every move counts, every decision is clear, and every trade moves you closer to your financial goals.

What's New

This tells us what new features and updates have been made in the HDFC SKY app.

Stock SIP

- Go to the SKY App > Search

- Search and select your preferred stock/ETF Example – HDFC Bank Ltd.

- Tap on Start SIP 4. Select your Preferred Exchange and Qty and Frequency. We provide you

- frequency option – Daily, Weekly, Fortnightly, Monthly. Example – Selecting Daily - Enter your preferred time for SIP trigger starting from 9:30 to 15:00 Example - Selecting Weekly - Select your preferred execution day Example – Selecting Fortnightly

- Tap on Calendar option and select your preferred SIP start date from calendar displayed. If you select date which is less than current date it will consider that start date of next month. If you select date which is current or greater than current date it will consider that start date of current month. Example – Selecting Monthly - Tap on Calendar option and select your preferred SIP start date from calendar displayed. If you select a date which is less than current date it will consider that as the start date of the next month. If you select a date which is current or greater than current day it will consider that start date of the current month. Example – Selecting 29th as start date - Select preferred time. Example – Selecting 9:30 am

- SIP start date is shown on screen – 29th of Every Month at 9:30 with SIP starts from 29th Aug’23 onwards

- Tap on Review Sip Order

- Tap on Create SIP order on SIP confirmation screen

- All done! Get status of your created SIP by clicking on “See Order Status”

- You can Pause/Modify/Delete your SIP by tapping on the SIP information card - Tap on your preferred option for further action. Example – Tap on Modify

- You can modify your Qty, SIP Frequency. - Click on “Review SIP Order”

- Review the changes and click on “Modify SIP order”

- SIP modification confirmation message

- Click on "Pause" to Pause your SIP - SIP Pause Successfully confirmation message will be displayed To Resume click on “Resume” To delete SIP click on “Delete”

- SIP orders can be review by clicking on the Hamburger menu on the top left hand side > SIP Orders

MF SIP

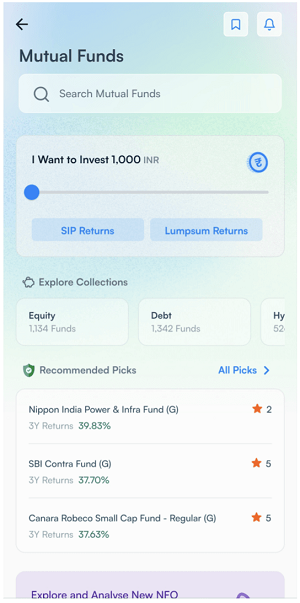

Discover the Mutual Funds in SKY!!

1.) Go to HDFC SKY dashboard and click on Mutual Funds

2.) Mutual Funds dashboard

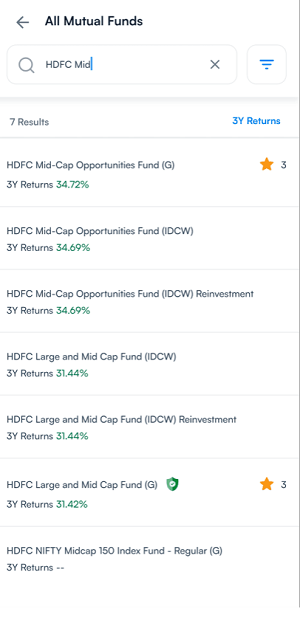

3.) Search for Mutual Funds

4.) Select Your desired Mutual Fund

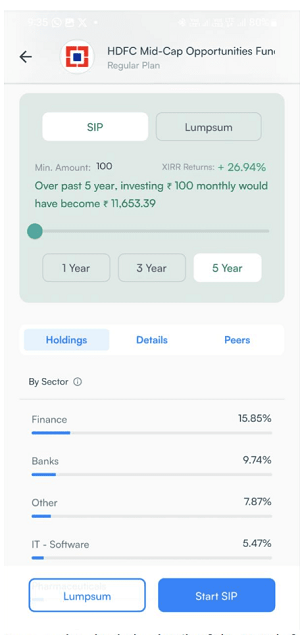

5.) You can see the details of past returns and Funds holdings details which shows top stocks where this MF scheme has invested.

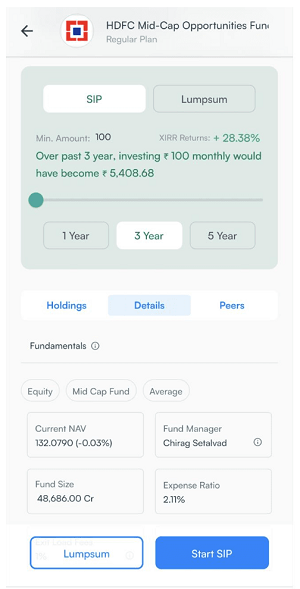

6.) You can also check the details of the Mutual funds scheme like Fund Size, NAV, Category, Fund Manager and Peers

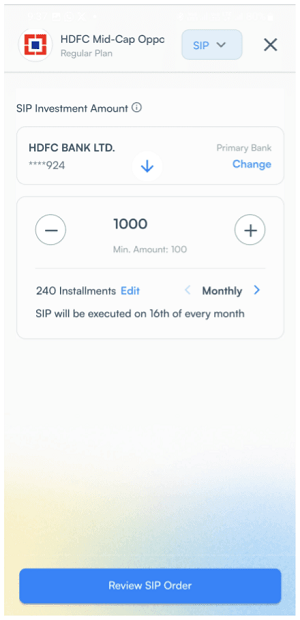

7.) Investing as a SIP

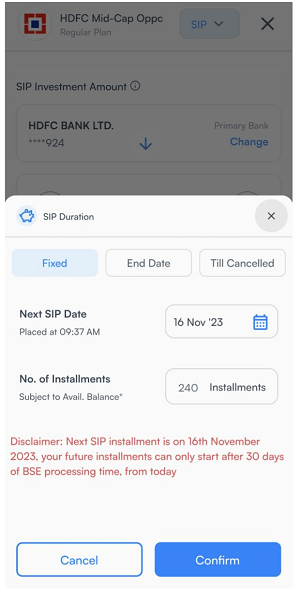

8.) Edit the SIP Date and frequency

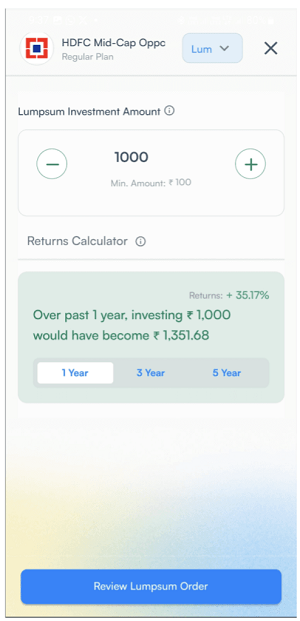

9.) Investing as a Lumpsum

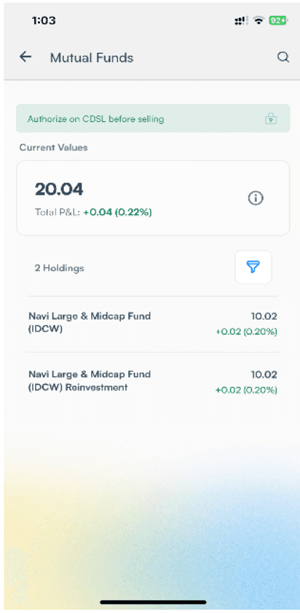

10.) You can see the all your Mutual Funds in the holding section

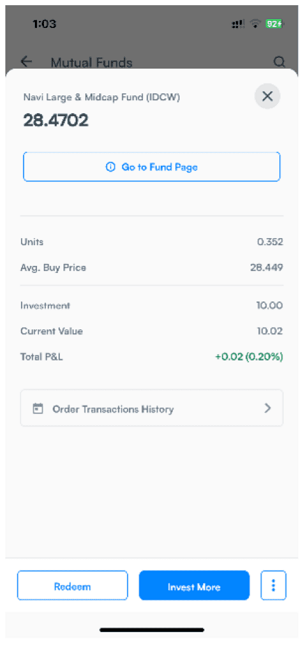

11.) You can check the number of available units, Average buy price by clicking on your invested Mutual Fund. You also has the option to Redeem or Invest more in the same Mutual Fund.

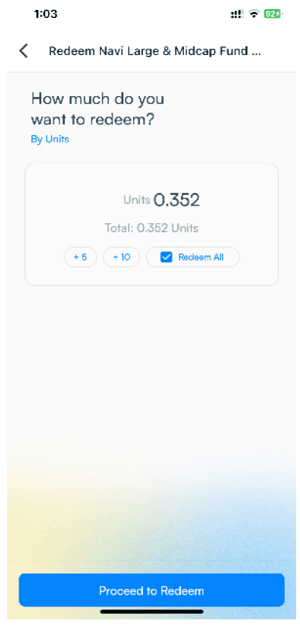

12.) By taping on Redeem below screen appear. You can mention the desired units for redeem and click on Proceed to redeem.

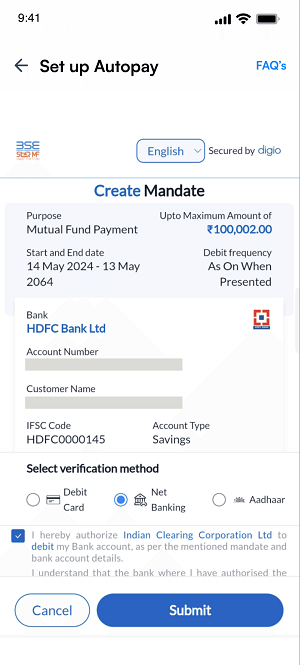

AutoPay Mandate:

- For placing SIP orders, it is compulsory to create mandate via Netbanking.

- Once you have placed first SIP order, you will be asked to set up autopay, follow the below steps to create mandate:

1. Once you see the below screen (take this as example), review the information and click on Submit.

2. You will be asked to login through Netbanking.

3. Once you have entered the login credentials, add OTP which you have received on your mobile number and click on Submit.

This will complete your Autopay Setup!

Learn

Stay ahead of the game with Curated courses & Research to help you navigate the complexities of financial markets This section is meant to assist any trader if they need to understand any concepts of trading and investing or just finance in general. The section is divided into 3 parts namely

- Investing course

- Trading course

- Personal and Behavioural Finance course

The section also leads you to some exciting videos that will help you learn new concepts and app features in a fun and interesting manner.

Fund Balance

This shows the available funds to invest/trade.

Market Movers

This section is meant for informations like Top gainers/losers 52 week high/low based on Nifty 500.

Explore Indian Markets

This section provides a lot of insights on the Indian markets based on the data like Most traded stocks Ongoing IPOs Market Movers ETFs News etc.

News

This section tells the latest news related on the market.